With zero savings, majority of Malaysians face dire straits in emergencies

The majority of Malaysians will likely struggle in the event of income emergencies as they have no financial assets and no banking or financial account of any kind, the Malaysia Human Development Report 2013 revealed.

More than half or 53% of Malaysian households have no financial assets, while one in three Malaysians do not have an account, the report commissioned by the United Nations Development Programme (UNDP) said.

Rural households have the highest number of those without any financial assets (63%), compared to 45% of urban households, and by ethnic group, Bumiputera and Malays chalked up the highest figures as those without such assets.

“Among ethnic groups, about 57% of non-Malay Bumiputera and 55% of Malays have no financial assets, with the figure for the Chinese and Indians at 45% and 44% respectively,” read the report which was released in Kuala Lumpur yesterday.

“In other words, roughly one out of two Malays, non-Malay Bumiputera, Chinese and Indians have no immediate liquid financial assets, making them vulnerable in the event of an income or employment shock.”

One in three Malaysians also had no banking or financial account, while among the bottom 40%, the figure was much higher, at 50%, said the report.

“In other words, one out of two low-income Malaysians do not have any financial accounts. Access to formal credit (or lack thereof) may also be the reason for the absence of financial assets,” it said.

The report stated that while Malaysia recorded a relatively high gross national savings rate, the bulk of the savings came from the corporate sector.

Citing figures from the Household Income Survey (HIS), the report also noted that nearly 90% and 86% of the rural and urban households, respectively, had no savings, while the majority of households at 88% had zero earnings from their savings.

Meanwhile, 57% of Malaysian households reported zero earnings from investments, with the figure for urban households at 50% and rural households at 66%, according to figures derived from dividend income earned.

The report did not take into account forced savings, such as the Employees Provident Fund (EPF), as households do not have access to such savings in the event of immediate income or employment shock.

But a breakdown of data from EPF savings as at 2013 showed equally worrying information: 90% of Malaysians nearing retirement age did not have enough funds to sustain a basic lifestyle for more than five years.

“Data from EPF shows that as at end of 2013, about one-fifth of Malaysians who are nearing retirement age (between the ages of 51 and 55) have less than RM20,000 in savings, while nearly 70% of those at the age of 54 have savings less than RM50,000.

“In other words, assuming a monthly expenditure of RM900 per month, the savings of the former could sustain their basic lifestyle for 1.8 years, while for the latter, the figure stands at 4.6 years.”

Though alarming, neither the low amount of financial assets or EPF savings were surprising, the report noted.

It also explained that the low EPF savings were due to the fact that the majority of Malaysians earned low wages.

“The monthly wage distribution from EPF shows that in 2013, one-third, or 2.1 million, active members earn less than RM1,000, slightly more than three-quarters (76.8%) earn less than RM3,000, and about 90% earn less than RM5,000 a month.

“As expected, the inequality in compulsory savings is rather extreme, where the top 1.7% of depositors in EPF has more savings than the savings of the entire bottom 57% combined,” added the report.

The authors said that the lack of financial assets, especially for the bottom 40%, severely limited their ability to borrow, invest, save and improve their economic opportunities.

The report was written by Tan Sri Datuk Dr Kamal Salih, an adjunct professor of Economics and Development Studies at Universiti Malaya (UM); Dr Lee Hwok Aun, from the UM Department of Development Studies, and Dr Muhammad Khalid of the Khazanah Research Institute.

The report was published for the United Nations Development Programme (UNDP), and was sponsored by both the UNDP and the Economic Planning Unit which is under the Prime Minister’s Department. – November 26, 2014.

Source: The Malaysian Insider www.themalaysianinsider.com

How Jack Ma Started?

It Took Jack Ma And His Group Of Friends 15 Years To Achieve Their Dreams. It Is Definitely Worth Their Efforts.

However, Most People Prefer To Be Employees. When Age Catching Up, They Start To “Wish” They Should Have “Try” To Be An Entrepreneur When They Were Still Young.

It Is Important For Fresh Graduates To Venture Into Business And Be An Entrepreneur. How To Go About? Visit Us At http://www.ibsadvisory.com.my/achieving-your-basic-dreams

What IF

In Life, We Have Too Many What “IF”!!! What IF I Can’t Make It? What IF She Rejects My Proposal? What IF I Don’t Do Well In Exams? What IF I can’t Get The Job? What IF…………………. Worst Still, All Are Negative. No More What IF, Just Do It

Alibaba’s Boss, Jack Ma Is The Richest Man In China

Alibaba, China’s Online-Shopping Giant, Completed The Largest Initial Public Offering In History Worth USD25 Billion As The Company Was Listed On The New York Stock Exchange On Sept. 19, ’14. Its Value Exceeded That Of Facebook, Coca-Cola Or IBM.

15 Years Ago, Jack Ma, A Former English Teacher Started Alibaba In An Apartment In The Chinese City Of Hangzhou. Today Alibaba Is The Undisputed Champion Of Online Retailing, Handling Twice As Much Merchandise As Amazon.

You Are Invited To Be Part Of Our Team To Build A Group Of Successful Entrepreneurs. http://www.ibsadvisory.com.my/entrepreneurship

You Got To Believe Yourself

To Succeed In Life, We Need To Have A Good Coach. A Good Coach Would Encourage Us, Would Motivate Us, Would Support Us, Would Never Give Up On Us. More Importantly, We Got To Give Our Absolute BEST.

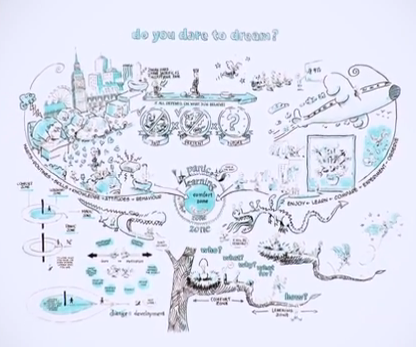

Dare To Dream

When We Were Small, We Dream To Become A Policeman, A Teacher, A Doctor, …… Unfortunately, As We Grow Older And Older, We Dare Not Dream Anymore. Why???

What Make A Person Successful And Another Person Not Successful? It Is Mainly Contributed By People Who He / She Mixing / Surrounded With. If You Want To Be Successful, Then You Must Be Surrounded By People Who Are Successful.

The Story Of Air Asia

Ask Any Kid, They Know Air Asia!!!

13 Years Ago, Air Asia Was Belonged To Hicom Group Before It Was Acquired By Tony & His Gang. They Have The Courage, The Vision, The Trust And Team Work To Rewrite The Story Of Air Asia. In A Short Period Of Time, Air Asia Has Been Voted As The World Best Budget Airline For Several Years.

Jimmy Choo

Professor Jimmy Choo, The Luxury Shoemaker, Has Raised 140p Per Share In An Initial Public Offering (“IPO”) On The London Stock Exchange, Bringing The Total Value To £545.6 Million (USD877 Million or RM2.8 Billion)!!!

According To Professor Jimmy Choo, In Order To Be A Successful Entrepreneur, We Must Have The Passion Of What We Are Doing. In Addition, We Have To Be Very Sincere To People. When Opportunity Comes, These People Would Introduce Us To Other Successful People And This Would Bring Our Success To Even Greater Height.

One Common Characteristic Of Successful Entrepreneurs Is They Are Willing To Share With Others How They Make It. They Want Those People Who Learn From Them Can Further Improve Their Ideas / Methods And Make It Even More Successful.